SBI Education Loan – Interest Rate, Eligibility, College List, Application

SBI Education Loan – The State Bank of India which is commonly known as SBI offers education loan for pursuing higher education in India as well as in abroad for various courses in leading institutions. The SBI has come up with various loan schemes such as Student Loan, Skill Loan, Scholar Loan, Global Ed-Vantage Loan, Take-over of Education Loans. The SBI Education Loan comes with low-interest rate, easy repayment options, moratorium period, income tax benefits, interest rate concession for female students and many other benefits.

With these many benefits, SBI education loans are the best option for many students in India. Students who are interested in SBI Education Loan must be aware of SBI Education Loan Eligibility, Courses, Rate of Interest, Repayment, Comparison in order to avail the loan. So in this article, we will explain to you with all the necessary information regarding the list of schemes that are covered under SBI Education Loan, eligibility criteria, courses covered, interest rates etc. Read on to find out everything about SBI Education Loan.

SBI Education Loan Eligibility Criteria For All Schemes

The SBI Education Eligibility Criteria for various schemes are listed below:

SBI Student Loan Eligibility – The SBI Student Loan is the loan offered by SBI for pursuing higher education in India or abroad. Students who belong to the Indian Nationality are eligible to avail this loan.

SBI Skill Loan Eligibility – The SBI Skill Loan is the loan granted to Indian Nationals for pursuing Skill development courses in India. The eligibility criteria for various training institutes and Schools are listed below:

- Training Institutes/ Courses: Courses run by Industrial Training Institutes (ITIs), Polytechnics, training partners affiliated to National Skill Development Corporation (NSDC)/ Sector Skill Councils, State Skill Mission, State Skill Corporation, preferably leading to a certificate / diploma / degree issued by such organization as per National Skill Qualification Framework (NSQF) are eligible for a SBI Skill Loan.

- Schools recognized by Central or State Education Boards or Colleges affiliated to recognized university leading to a certificate/diploma/ degree issued by such organization as per National Skill Qualification Framework (NSQF) is eligible for SBI Skill Loan.

SBI Scholar Loan Eligibility – The SBI Scholar Loan is the loan granted for pursuing higher education in “Select Premier Institutions” in India. The eligibility criteria for SBI Scholar Loan are listed below:

- Students who belong to the Indian Nationality are eligible.

- Students must have secured admission to Professional/Technical courses in “Selecr Premier Insititions” through entrance test or selection process.

The List of Select Premier Institutions in India is tabulated at the end of the article.

SBI Global Ed-Vantage Loan Eligibility – SBI Global Ed-Vantage is an overseas education loan especially for those who wish to pursue full time regular courses at foreign colleges/universities. Students who belong to Indian Nationals are eligible for SBI Global Ed-Vantage Loan.

SBI Education Loan – Courses Covered

Several courses are being offered under SBI Education Loan. The list of courses covered under each scheme are listed below:

Courses Covered Under SBI Student Loan:

Courses Offered In India:

- UG and PG degree from UGC/ AICTE/IMC/Govt. Approved Institutions.

- Regular Degree/ Diploma Courses from top institutions such as IIT, IIM, etc.

- Teacher training/ Nursing courses approved by govt and central courses.

Courses Offered In Abroad:

- MCA, MBA, MS, and various other degrees offered by top universities.

- Courses by CIMA ( Chartered Institute of Management Accountants) – London, CPA ( Certified Public Accountant) – USA, etc.

Courses Covered Under SBI Scholar Loan:

- Regular full-time DegreeCourses through entrance test/ selection process.

- Regular full-time Diploma Courses through entrance test/ selection process.

- Full-time Executive Management Courses like PGPX.

Courses Covered Under SBI Skill Loan:

- List of courses offered by ITIs, Polytechnics, National Skill Development Corporation.

- Certificate/Diploma/Degree courses issued by any organization as per National Skill Qualification Framework (NSQF).

Courses Covered Under SBI Global Ed-Vantage Loan:

Regular UG/ PG/Ph.D. courses in all disciplines offered by foreign Institutes in the USA, UK, Canada, Australia, Europe, Singapore, Japan, Hong Kong, and New Zealand.

SBI Education Loan – Expenses Covered

The SBI education loan covers various expenses including Admission Fee, Tuition fee, Hostel Fee/Living Expenses. The list of expenses covered under each scheme are listed below:

Expenses Covered Under SBI Student Loan:

- School fees, Hostel fees, and College fees will be paid by SBI.

- Fees payable to Exams, Library and Laboratory.

- Purchase of Books/Equipment/Instruments/Uniforms, Purchase of computers- essential for completion of the course (Maximum 20% of the total tuition fees payable for completion of the course)

- Caution Deposit/Building Fund/Refundable Deposit (Maximum 10% of tuition fees for the entire course)

- Travel Expenses/Passage money for studies abroad

- Cost of a Two-wheeler up to Rs. 50,000/-

- Any other expenses required to complete the course like study tours, project work, etc will also be paid

Expenses Covered Under SBI Scholar Loan:

- Fees payable to College or School or Hostel

- Examination/ Library/ Laboratory fees

- Purchase of Books/Equipment/Instruments

- Caution deposit/building fund/ refundable deposit supported by Institution bills/ receipts (The amount should not exceed 10% of the tuition fees for the entire course)

- Travel expenses/expenses on an exchange programme ( No voucher/ receipt required, purpose (end-use) need to be self-certified)

- Purchase of computer/laptop ( Expenditure not to exceed 25% of the loan amount (up to a lumpsum amount of max Rs. 1 Lac))

- Any other expenses related to education ( Expenditure beyond 25% cap permitted subject to production of voucher/ receipt)

Expenses Covered Under SBI Skill Loan:

- Tuition / Course Fee

- Examination / Library / Laboratory fee

- Caution deposit

- Purchase of books, equipment and instruments

- Any other reasonable expenditure found necessary for the completion of the Course.

Expenses Covered Under SBI Global Ed-Vantage Loan

- Fee payable to college/school/hostel.

- Examination/Library/Laboratory fee.

- Travel expenses/passage money for studies abroad.

- Purchase of books/equipments/instruments/uniforms/ computer at reasonable cost, if required for course completion and any other expense required to complete the course– like study tours, project work, thesis, etc. can be considered for loan subject to the condition that these should be capped at 20% of the total tuition fees payable for completion of the course.

- Caution deposit /building fund/refundable deposit supported by Institution bills/receipts the amount considered for the loan should not exceed 10% of the tuition fees for the entire course.

SBI Education Loan – Loan Amount and Security

- SBI Student Loan Scheme Amount and Security

Loan Amount – SBI Student Loan Scheme offers a maximum of INR 10 lakhs for studies in India and whereas for students opting abroad, this scheme offers a maximum of INR 20 lakhs.

- For loan amount up to INR 7.5 lakhs does not require any collateral security or third-party guarantee. Only parent/guardian as co-borrower are considered.

- Tangible collateral security and parent/guardian as co-borrower are required for loan amount above INR 7.5 lakhs.

2. SBI Scholar Loan Scheme Amount And Security

- The minimum loan amount is of INR 7.5 lakhs and the maximum loan amount is INR 40 lakhs is offered under SBI Scholar Loan scheme depending upon the type of institution the student is opting for.

- Minimum loan amounts for all covered institutions, no security is required; only parent/guardian can act as the co-borrower.

- Maximum loan amount for List A and List B institutions, tangible collateral of full value and parent/guardian as co-borrower are necessary.

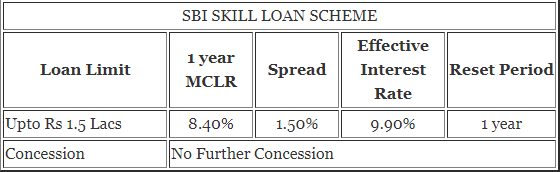

3. SBI Skill Loan Scheme amount and security

- SBI Skill Loan Scheme grants a minimum loan amount of INR 5,000 and a maximum loan amount of INR 1,50,000.

- No collateral or third-party guarantee is required. Only parent/guardian as co-borrower are considered.

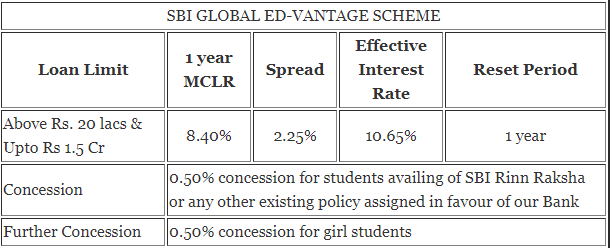

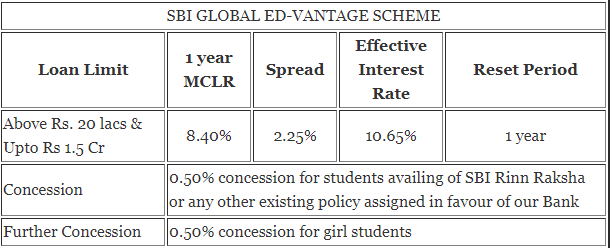

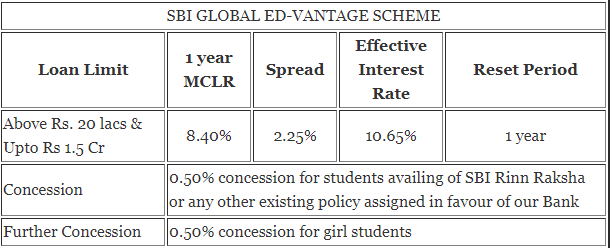

4. SBI Global Ed-Vantage Scheme amount and security

- SBI Global Ed-Vantage Scheme offers a minimum loan amount of INR 20 lacs and maximum loan amount of INR 1.5 Cr.

- Tangible collateral security is required.

- Collateral security offered by third-party (other than parents) will also be accepted here.

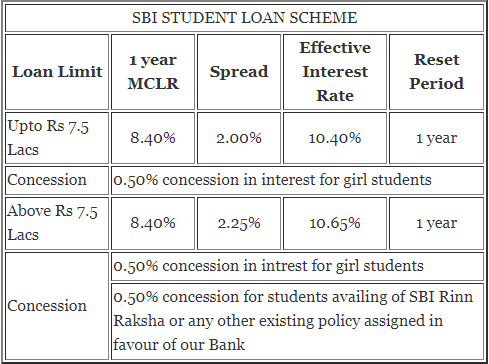

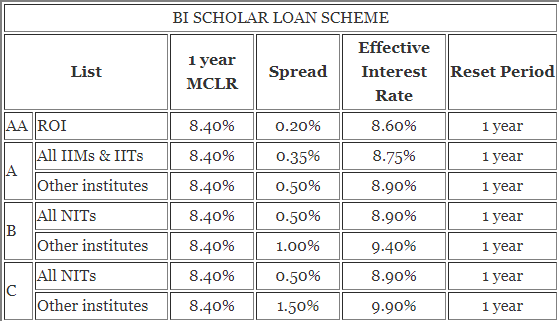

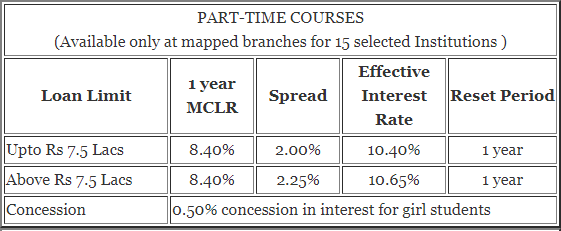

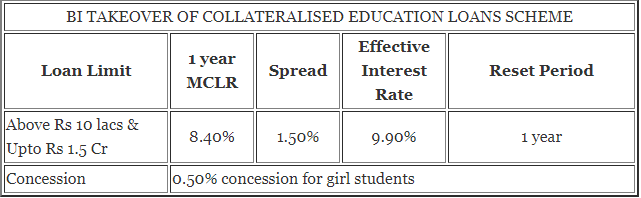

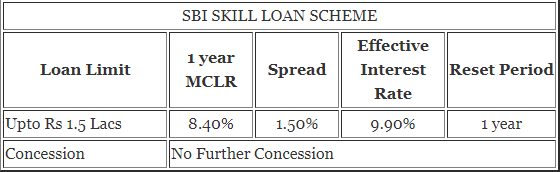

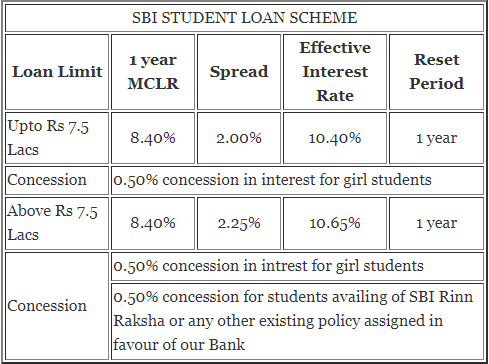

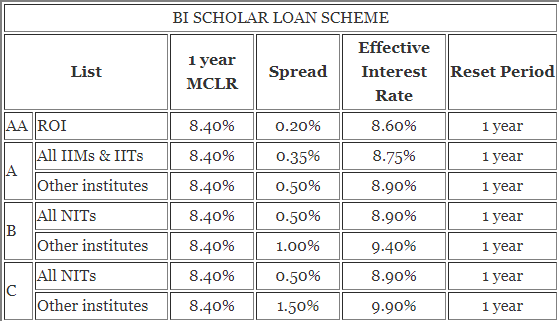

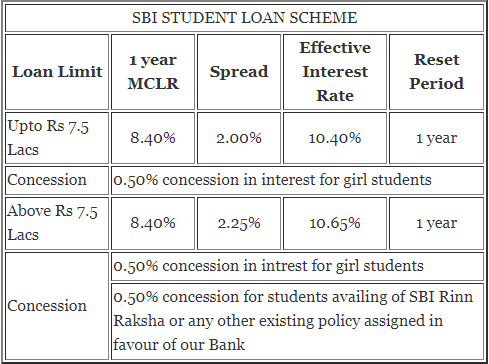

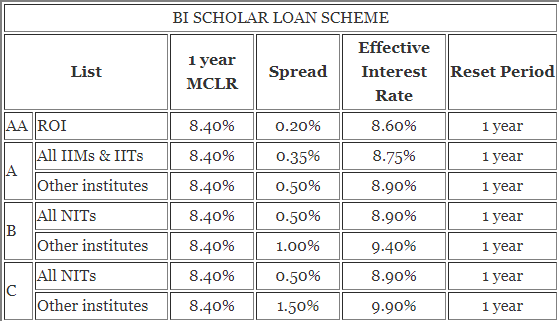

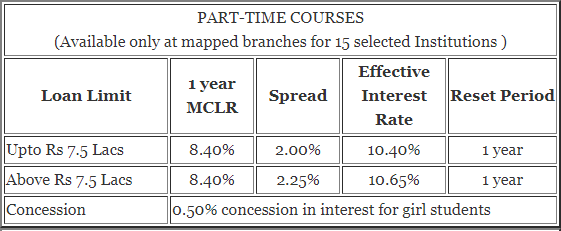

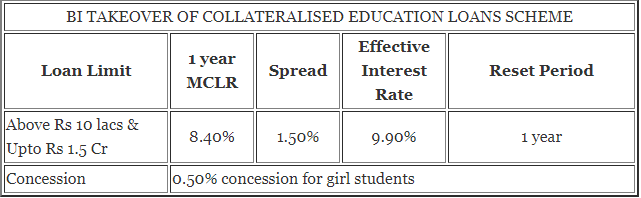

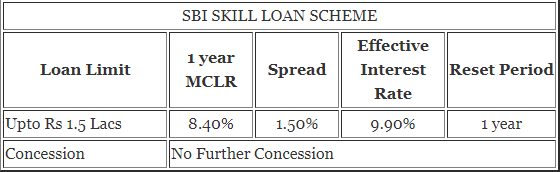

SBI Education Loan – Interest Rate

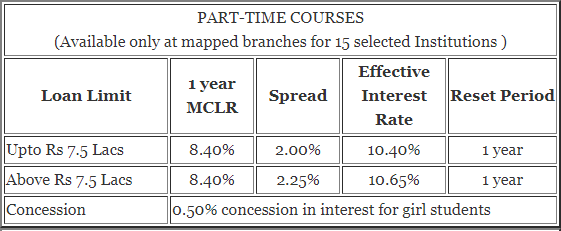

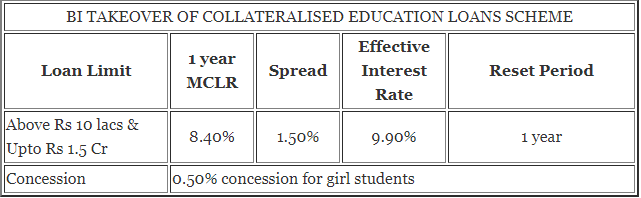

SBI education loan comes with low-interest rates and also there are special permits for female students. In the below table we have listed down the loan limit, institution code and the interest rate for each scheme under Education Loan.

EDUCATION LOAN SCHEMES – RATE OF INTEREST (w.e.f. 10.07.2019)

SBI Education Loan – Repayment Rules

The repayment rules for each scheme under SBI Education Loan varies. The repayment rules under various shcmes are listed below:

SBI Student Loan Repayment Rules:

- Students must start repaying the amount one year after the completion of course.

- The loan has to be rapaid within 15 years once the repayement is intitiated.

- In case if students avail any loan for higher stuides, the same shoud be repayed by combing the amount within 15 years after the completion of the second course.

SBI Skill Loan Repayment Rules:

| Loan Amount | Repayment Period in Years |

| Loans up to Rs 50,000 | Up to 3 years |

| Loans between Rs 50,000 to Rs 1 lakh | Up to 5 years |

| Loans above Rs. 1 lakh | Up to 7 years |

SBI Scholar Loan Repayment Rules:

- Students must start repaying the amount one year after the completion of course.

- The loan has to be rapaid within 15 years once the repayement is intitiated.

- In case if students avail of any loan for higher stuides, the same should be repayed by combing the amount within 15 years after the completion of the second course.

SBI Global Ed-Vantage Loan

- Repayment will commence 6 months after completion of course

- Repayment upto maximum of 15 years

- Accrued interest during the moratorium to be added to the principal and repayment in EMI fixed.

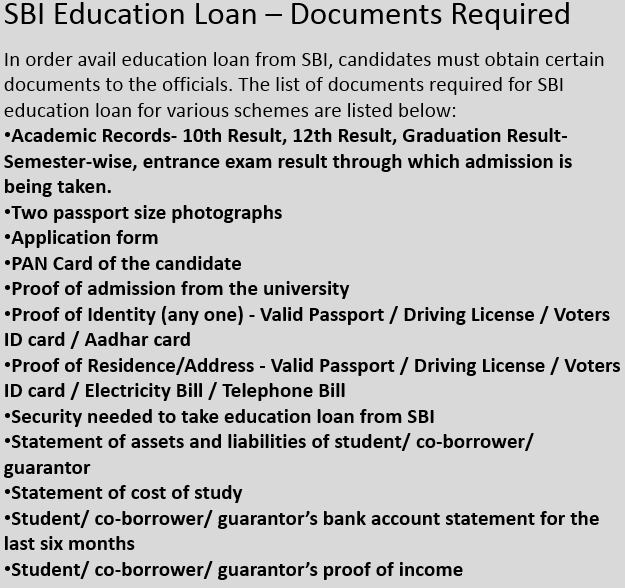

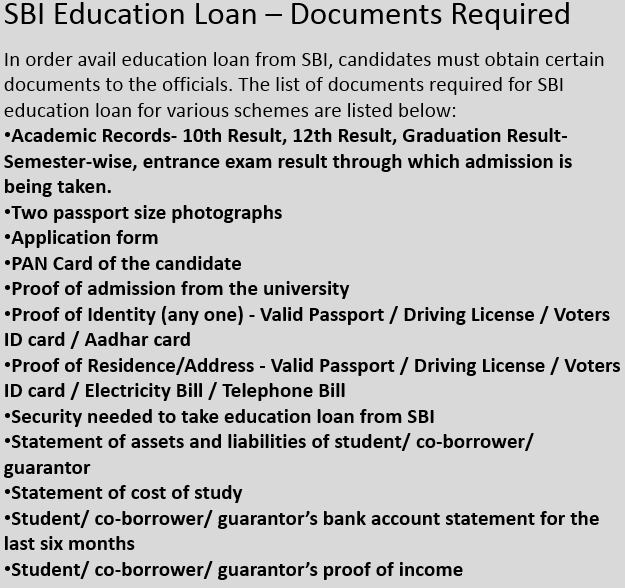

SBI Education Loan – Documents Required

In order avail education loan from SBI, candidates must obtain certain documents to the officials. The list of documents required for SBI education loan for various schemes are listed below:

- Academic Records- 10th Result, 12th Result, Graduation Result- Semester-wise, entrance exam result through which admission is being taken.

- Two passport size photographs

- Application form

- PAN Card of the candidate

- Proof of admission from the university

- Proof of Identity (any one) – Valid Passport / Driving License / Voters ID card / Aadhar card

- Proof of Residence/Address – Valid Passport / Driving License / Voters ID card / Electricity Bill / Telephone Bill

- Security needed to take education loan from SBI

- Statement of assets and liabilities of student/ co-borrower/ guarantor

- Statement of cost of study

- Student/ co-borrower/ guarantor’s bank account statement for the last six months

- Student/ co-borrower/ guarantor’s proof of income

Save this image – Documents Required for Education Loan

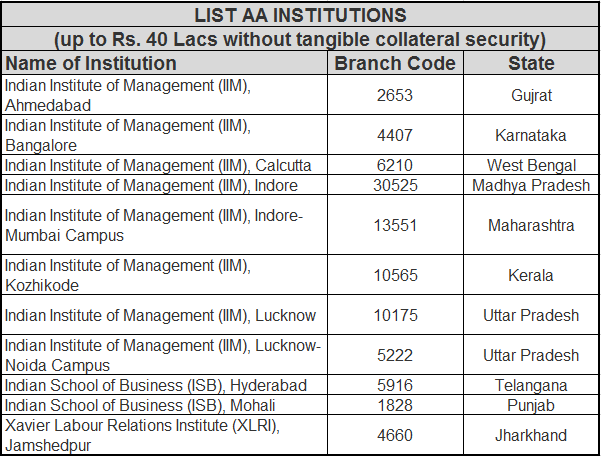

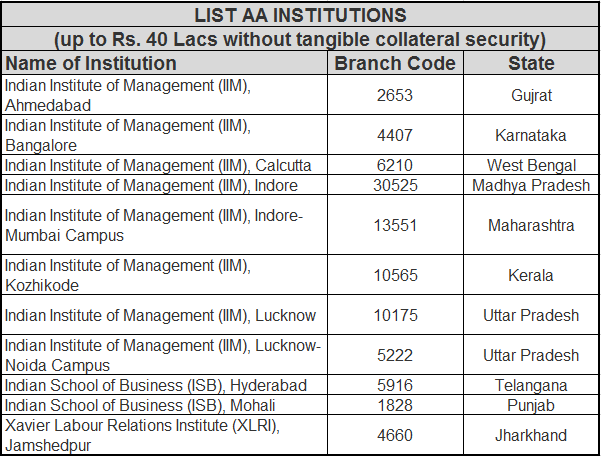

SBI Scholar Loan Scheme – List of Approved Institutions

List of AA Institutions are tabulated below:

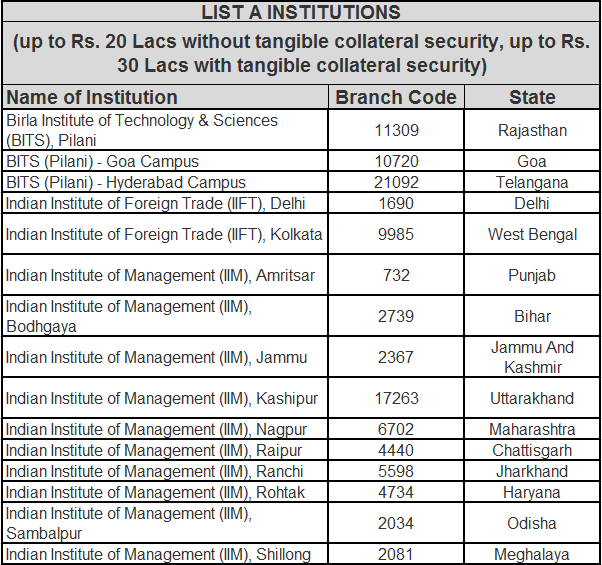

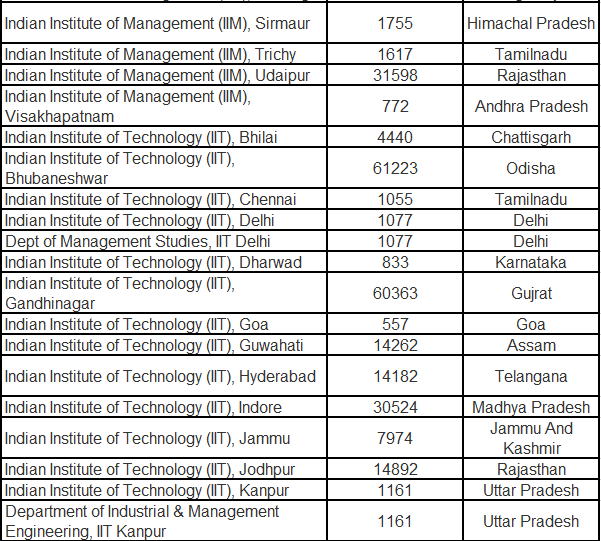

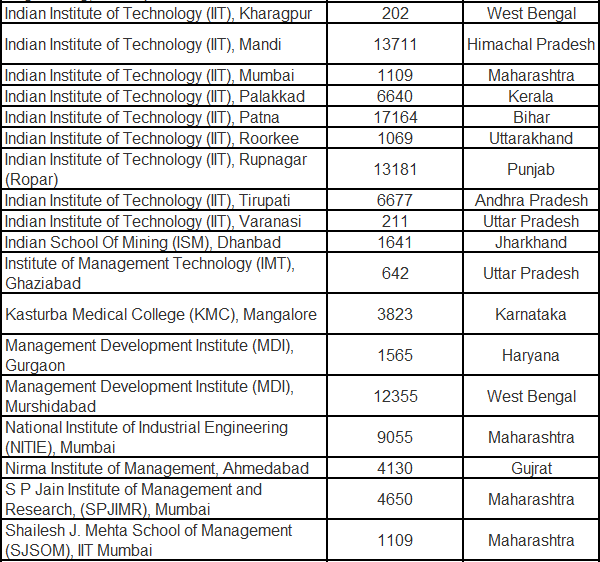

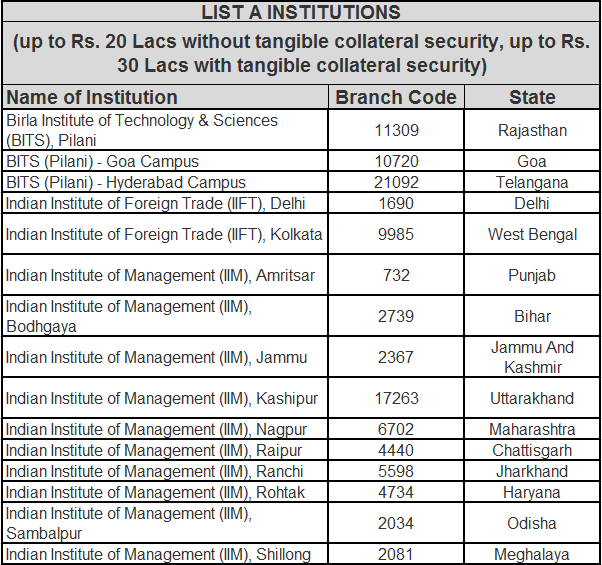

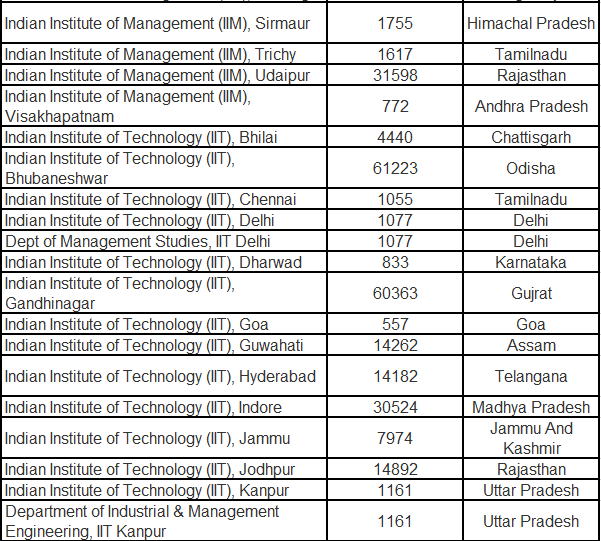

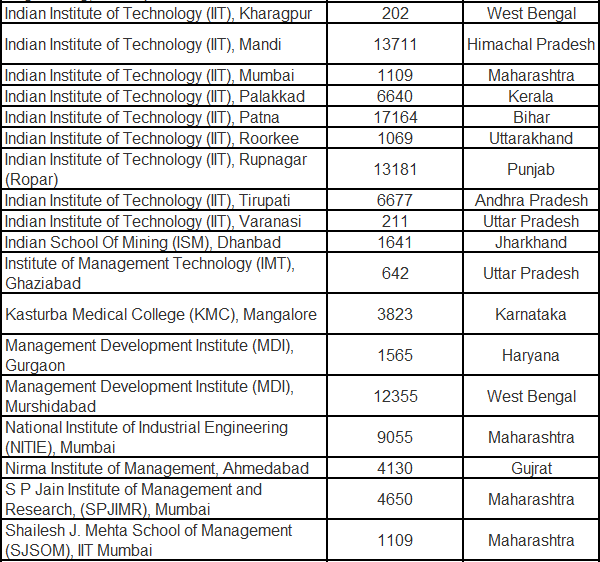

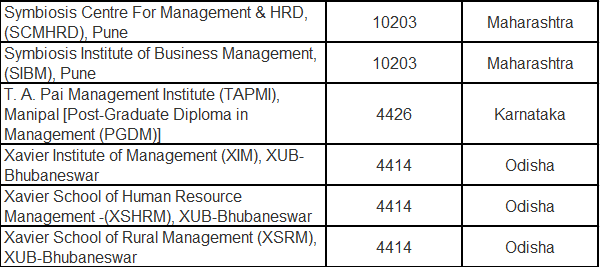

List of A Institutions under SBI Education Loan are tabulated below:

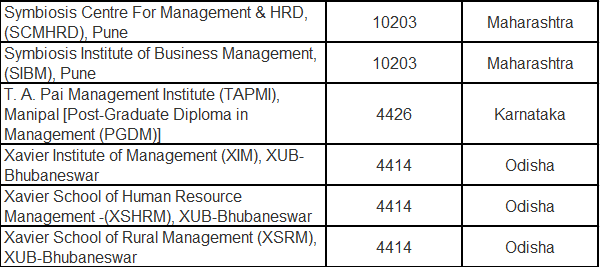

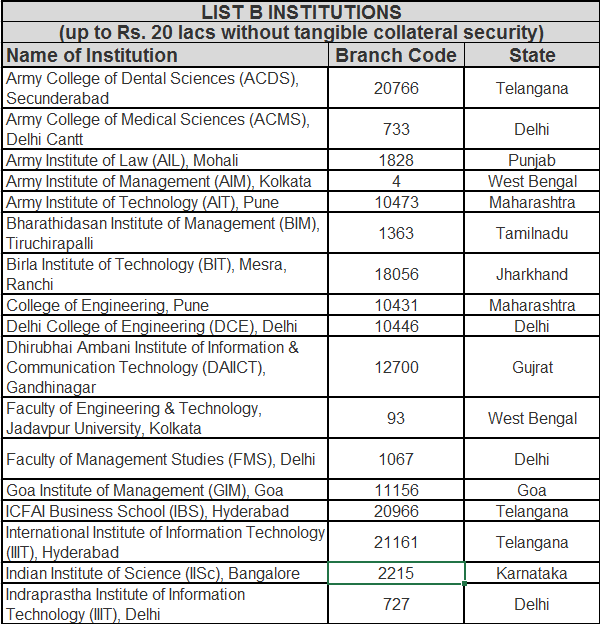

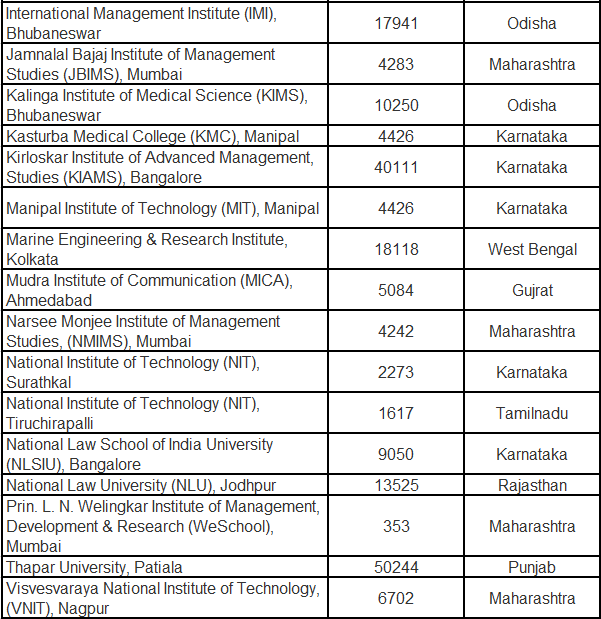

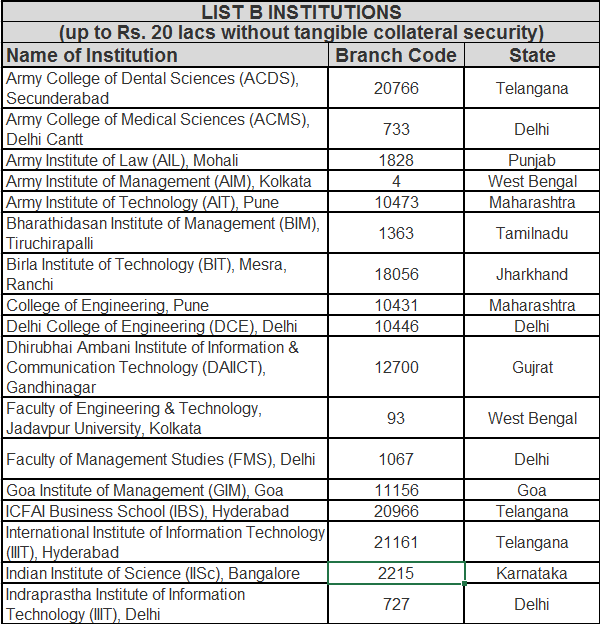

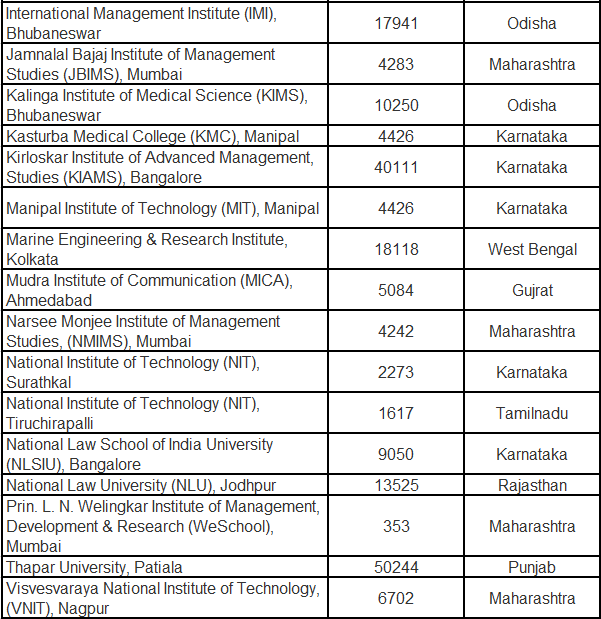

List of B Institutions under SBI Education Loan

List of C Institutions under SBI Education Loan

| List of C Institutions |

| Name of Institution | Branch Code | State |

| Centre for Environmental Planning & Technology |

Governance (XUMG) [Post Graduate Programme in

Graduate Programme in Sustainability

FAQs Regarding SBI Education Loan

The frequently asked questions regarding SBI Education Loan are listed below:

Question 1. How to get an education loan from SBI?

Answer 1: The procedure get Education Loan from SBI is very simple. Follow the step by step procedure as listed below to avail SBI education loan:

- Step 1 – Visit the official website of SBI .

- Step 2 – Now on the home page, in the left side bottom corner of the screen, you will find a list of schemes.

- Step 3 – Click on the scheme under which you want to avail the SBI education loan. (SBI Student Loan, SBI Skill Loan, SBI Scholar Loan, SBI Global Ed-Vantage Loan).

- Step 4 – The page will be directed.

- Step 5 – Now carefully read all the information provided and hit the button “Apply Online Now”.

- Step 6 – Start Filling the application form to get education loan from SBI.

Question 2. What is the procedure for education loan in SBI?

Answer 2 . Follow the procedure as listed below to get education loan from SBI.

- Step 1 – Visit the official website of sbieducationloan.co.in

- Step 2 – Read the instructions carefully provided on the page.

- Step 3 – Click on Apply Now

- Step 4 – A pop up appears “ Please Confirm – I need an education loan to (Study in India or Study In Abroad)”

- Step 5 – Select the button which you want and the page will be directed.

- Step 6 – Now start filling the application form and upload all the necessary documents.

Question 3. Which bank has lowest interest for education loan?

Answer 3 . SBI offers lowest interest rate in the market with interest rates as low as 8.65%.

Question 4- Can I get education loan without security?

Answer 4 – According to SBI, for loan amount up to INR 7.5 lakhs does not require any collateral security or third-party guarantee. Only parent/guardian as co-borrower are considered.

Question 5. How can I check my education loan status in SBI?

Answer 5 – Generally education loan processing may take anything between 7 to 10 days from the day of submission of complete loan application with required documents.

- Students can make call to the following number to know about their SBI loans – 1800 112 211 or 1800 425 3800.

- If not students can visit the nearest branch to enquire regarding the same.

- Also students can login with the help of their credentials to check their education loan status.

Question 6 – How can I apply for education loan?

Answer 6 – Students who wish to apply for education loan in SBI must visit the official page of SBI Education Loan Page. Students must know the terms and conditions completely and start filling the application form. Also The loan is available from all branches in metro/urban areas as well as those having personal banking divisions.

Question 7 – What are the important documents that I need to provide?

Answer 7 – Students will need to furnish the following documents along with the completed application form. Relevant information would relate to the guardian and the student both, when the loan is jointly taken.

- Mark sheet of last qualifying examination for school and graduate studies in India

- Proof of admission to the course

- Schedule of expenses for the course

- Copies of letter confirming scholarship, etc.

- Copies of foreign exchange permit, if applicable.

- 2 passport size photographs

- Statement of Bank account for the last six months of the borrower

- Income tax assessment order not more than 2 years old

- A brief statement of assets and liabilities of the borrower.

- If you are not an existing bank customer you would also need to establish your identity and give proof of residence.

Question 8. How to link education loan account in SBI online?

Answer 8. Please visit the nearest website to know all details about how to link the education loan account in SBI online.

Question 9. How to close education loan in SBI?

Answer 9 . You first have to prepay your entire outstanding due amount. Then submit an application form with the branch to close the education loan account. The lender will then issue a “Letter of Closure” Or “No Dues Letter” which clearly states that the amount has been fully paid and no money is due. Once you receive the letter, you can consider the account officially close.

Now that you are provided all the necessary information regarding SBI Education Loan and we hope this detailed article is helpful. If you have any questions regarding this article or SBI Education loan, drop your comments in the comment box below and AplusTopper team will get back to you as soon as possible.